cryptocurrency capital losses

Johns crypto tax obligations. Long-Term Capital Gains and Losses.

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

Cryptocurrency exchanges are not required to provide a 1099-B or summary tax statement for cryptocurrency transactions.

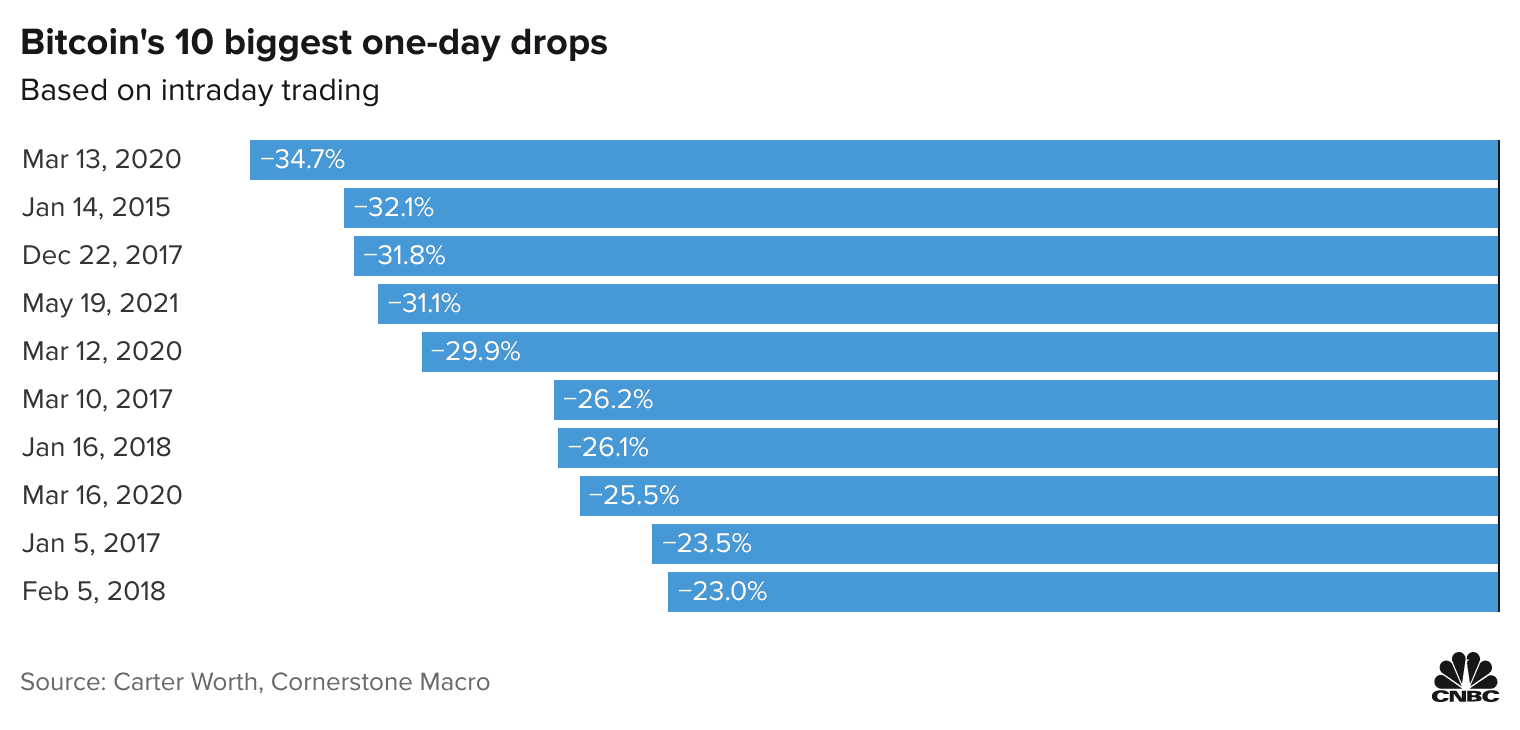

. You can buy actual cryptocurrency on exchanges where you own the underlying asset. Therefore profits as well as losses are magnified. A capital loss can also be used to reduce the tax burden of future capital gains.

How do I file cryptocurrency losses on my tax return. Suppose you sold two investments last year. You also bought stock in another company at 800 which you later sold for.

As of 2011 however the Internal Revenue Service created a new form Form 8949 that some taxpayers will have to file along with their Schedule D. Use these losses to reduce any capital gains in the current year but check the restrictions below use the earliest losses first. Cryptocurrency trading has become really popular in the past years.

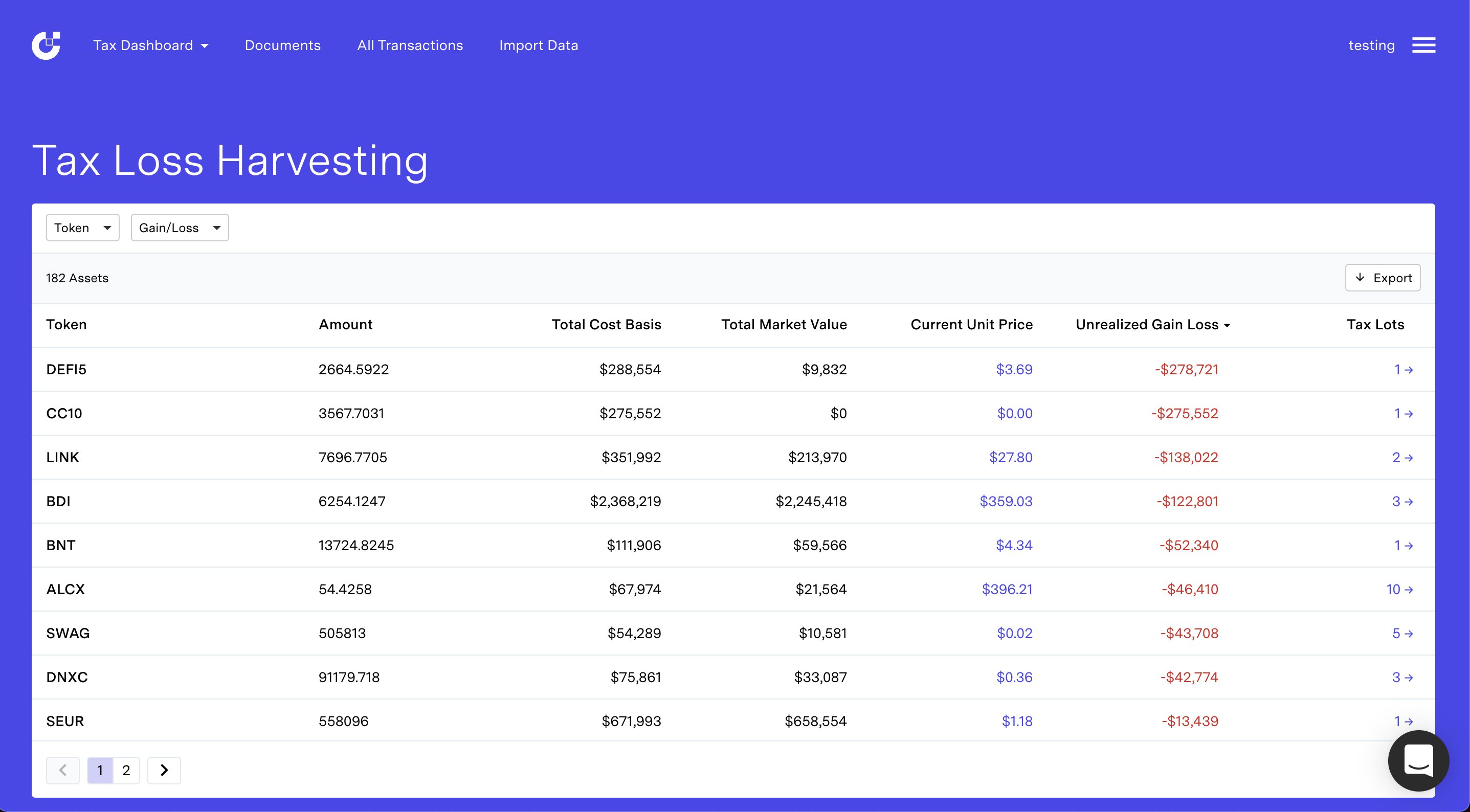

Capital losses can be used to reduce capital gains made in the same financial year or a future year including investments outside of cryptocurrency. You bought a cryptocurrency holding high and sold it low for a 35000 loss. Selling using or mining bitcoin or other cryptos can trigger bitcoin taxes.

To him his native country is a terrific place to run a business as. Heres a guide to reporting income or capital gains tax on your cryptocurrency. This is considered a long-term investment as you are waiting for the price to rise significantly before.

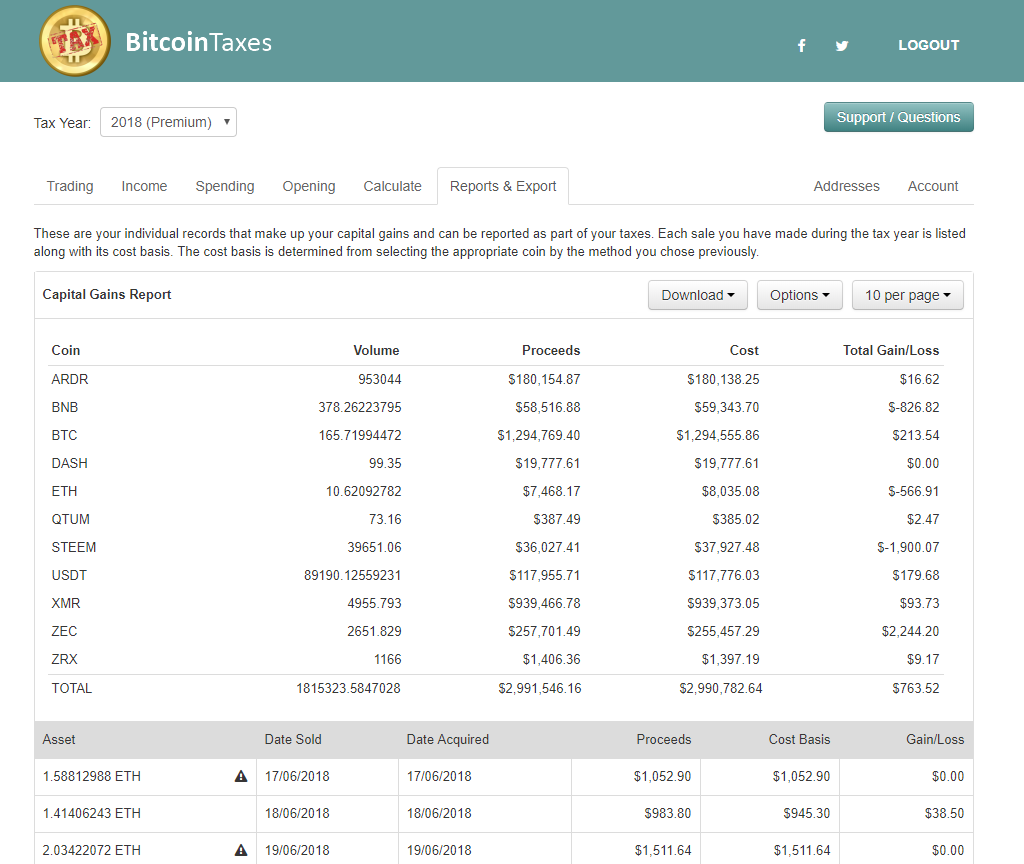

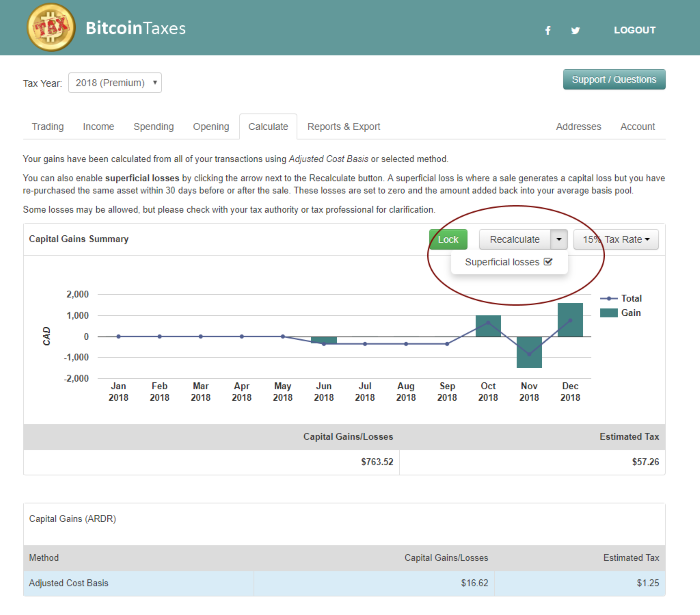

It automatically categorize users transaction history and supports Pools Airdrops Mining rewards ICOs OTC lost or stolen funds crypto payments. Losses are not unusual and you want to be able to rightfully claim any losses for tax-saving results. Your capital gains and losses from your crypto trades get reported on IRS Form 8949.

A capital loss is a loss on the sale of a capital asset such as a stock bond mutual fund or real estate. Reporting crypto capital gains and losses. Tax experts say if a cryptocurrency is held as a capital asset then the profit or loss from it should be reported as capital gains or loss.

If you have any capital losses in the current year or unused capital losses from previous years you must. The wash sale rule applies to any and all transactions even through separate accounts so youll want to keep your own accurate records. Capital losses must be used at the first opportunity.

Youll receive a 1099-K if you made over 200 cryptocurrency transactions or your proceeds exceeded 20000. Each sale of crypto during the tax year is reported on the 8949. On the other hand if you bought Bitcoin for 10000 after fees and sold it for 5000 you lost 5000.

Bitcoin And Other Majors Coins Extend Losses As China Warns State-Owned Firms On Cryptocurrency Mining. As with stock trades capital losses offset capital gains in full and a net capital loss is limited to 3000 1500 for married taxpayers filing separately against other types of income on an individual tax return. Everybody can sign up and start trading Bitcoin or other crypto coins.

Can crypto capital losses offset stock capital gains. However note that CFDs are a leveraged product. Undertanding the 1040 Schedule D is particularly important.

See the total cryptocurrency market capitalization charts and DeFi coins market cap as well as Bitcoin market cap Bitcoin dominance and more. The Form 8949 is the tax form used to report cryptocurrency capital gains and losses. Your cryptocurrency tax rate is dependent on several factors such as your income and the length of time you held your cryptocurrency.

CFDs allow trading on margin providing you with greater liquidity and easier execution. Capital Losses Offset Capital Gains. If youre unsure how to file crypto taxes be sure to check out our guide.

Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year. CryptoTaxCalcultor is another automated platform to get all information depending upon your capital gains in all your cryptocurrency investment. An excess capital loss is carried forward to the subsequent tax year.

A buccaneering 37-year-old educated in a British private school Michael Chobanian is fluent both in English and the folkways of Ukraine which he regards as a largely lawless frontier and which he likes to traverse in his black Ferrari 612He is the founder of Kuna one of Eastern Europes first cryptocurrency exchanges. If this asset is held for more than 36 months then the gainslosses should be classified as long-term capital gains or losses and if sold before three years then the gainslosses will be treated as short. You report your crypto losses with the Form 8949 and 1040 Schedule D.

Its growing more ever year. Many big trading brokers have already added some of these cryptocurrencies. Even if you dont have capital gains you can use a capital loss to offset ordinary income up to the allowed amount.

This means that transactions canand often dofall through the cracks. Capital losses from cryptocurrency can be used to offset capital gains from stocks cryptocurrency and other asset classes subject to capital gains tax. If you had other non-crypto investments they need to be reported on separate Form 8949s when you file your taxes.

You bought one stock for 850 which you later sold for 1000 so you made a profit of 150. If you have more losses than gains you can deduct up to 3000 from your taxable income 1500 if youre married and filing separately and carry over the additional losses to the next year. However cryptocurrency users must deal with capital gains and losses in addition to whatever sales taxes they might face at the point of sale.

Brokers should report wash sales to the IRS on Form 1099-B and provide a copy of the form to the investor but theyre only required to do so per account based on identical positions. As with capital gains capital losses are divided by the calendar into short-. This is the easiest and probably the simplest way to invest in cryptocurrency.

You can deduct the losses to offset capital gains. Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency. There are two options when trading in the cryptocurrency market.

Bitcoin Crash Opens Door To A Tax Loophole For Investors

How To Report Cryptocurrency On Taxes Tokentax

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Crypto Hedge Funds Struggle To Recover From Bloodbath Free To Read Financial Times

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

.jpg)

Can You Avoid Crypto Taxes Cryptotrader Tax

Save Money On Crypto Taxes With Tax Loss Harvesting Tokentax

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

.png)

Reporting Stolen Or Lost Cryptocurrency For Tax Purposes Cryptotrader Tax

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Ato Expecting To Collect 3 Billion In Tax Fines From

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Bitcoin Btc Price Plunges As 260 Billion Wiped Off Cryptocurrencies

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Infocus The Pros And Cons Of Cryptocurrency Investment Efg Asset Management